The Unique Property

Site Blog

Three Ways to Look at Investing

Watch on Youtube: https://youtu.be/A12N27Wfz2k

Investing is a precarious enterprise. How did you know that investing in Amazon in the late nineties was going to turn every £1,000 into more than two million? In one sense it is easy, and I'll suggest the easiest way. But as with all of these questions you have to start with some sort of ground rules.

Even before we get to some rules, let me state what is hopefully obvious. This is a ten minute blog, not a 500 page text book. I scratch the surface. If there are particular points in this brief encounter that you would like me to explore further do let me know.

Rule one is to arrange your affairs so you have money available to work for you. But this comes with a caveat. You don't want to put your way of life at risk. You must never get into a situation where you could be ruined. You need to make sure the books balance, then you can lose some money but not lose sleep.

The second thing to do is to make sure you use investment's number one reliable feature: compounding. This means when you start your investing career, and the earlier you do that the more wealth you will acquire, you should look to invest in the basic industries that will go on and on producing money and raising their dividends. You should be investing in stocks such as Coca Cola, Johnson and Johnson, Glaxo, and so on. Then forget about them, and let them build over the decades.

That's one leg of your plan. In the seventies we had a major crash, followed by a grinding bout of high inflation. However, I soon learned that crashes were an investor's dream. Welcome to the second leg of your investment strategy.

The young investor has to learn that a good wham-bang crash can set you up. You just have to see it coming. There are signs. I'll go into that specifically in next week's blog, because we are possibly approaching such a situation right now, but I want to analyse how we work out what is really going on.

Let's analyse the pros and cons of a market crash.

The downside of such a situation is that those who have invested in pension plans are going to take a hefty hit. If you are going to buy shares then dont invest in a pension scheme. Every month they have money coming in, and so they have to park it somewhere. It goes into stocks. Pension funds usually can't just cash out all their positions because they think a crash is coming, so the obvious problem is that your pension money goes down with the crash. Dont get caught out that way. Eschew pension funds.

Now think like a sensible woman. There is a market crash. Prices maybe halve. What would the average lady do when walking down the high street? She looks in the shop windows, fancies a particular coat or skirt, but doesn't like the price. One day the skirt is on sale at half price. What does she do? Nips in sharpish and buys it.

Now let's return to the stock-market. You like Company A and your searches show it to be good value at £100. The dividend isn't too bad either at 3%. You think there is likely to be a market crash in the offing. The average guy will, once the market has crashed, sell everything. You, however, now see Company A trading for £50. If it was a good deal at £100, then it must be a steal at £50. And, of course, the dividend is now a much more interesting 6%. Clearly, it is time to buy.

The High Street has sales. The stock-market has crashes. They are both signals that it is time to buy. Most people do the opposite. They wait until a bull market has worked up a head of steam and then decide to buy. Remember, the ideal rule is buy low and sell high. Most personal investors do the opposite.

The third leg of our investment advice is to invest in what might be called the flavour of the decade. When I started investing, rather a long time ago, I decided that the in-thing was to sink funds into real estate. This asset had everything going for it. Mortgages were at last becoming mainstream, which meant people could afford to pay a lot more for houses than when they had to stump up either the whole cost price, or a large proportion of that. That meant house prices were certain to rise with the ability to pay, and buying a house was also the socially in-thing to do. I invested in real estate.

The third leg of your scheme is to follow the trends, as mentioned at the beginning. In the sixties and early seventies the trend was clearly housing. In the early eighties it was housing again, and Japanese Unit Trusts. In the early nineties it was housing again. The crash brought some amazing buys in the UK market. I was buying properties for rental that had a P/E ratio of 1. That's insane value, but the idiot banks wouldn't lend on purchases. That's when I and my friend Gerry started Buy-to-Let, and when I wrote my first book on the subject, which no publisher would touch, so I published it myself in 1993.

From 1991 to 2004 if you chose the right part of the UK you could make money hand over fist in real estate.

You had another market crash in the year 2000, so the obvious place to be in 2001 was the stock-market. And what was the in-thing? Going digital. The whole of the nineties was about the beginning of the digital age. I was busy with both the internet and real estate all through the nineties, but once we had the crash I knew it was time to hit digital stocks with a vengeance.

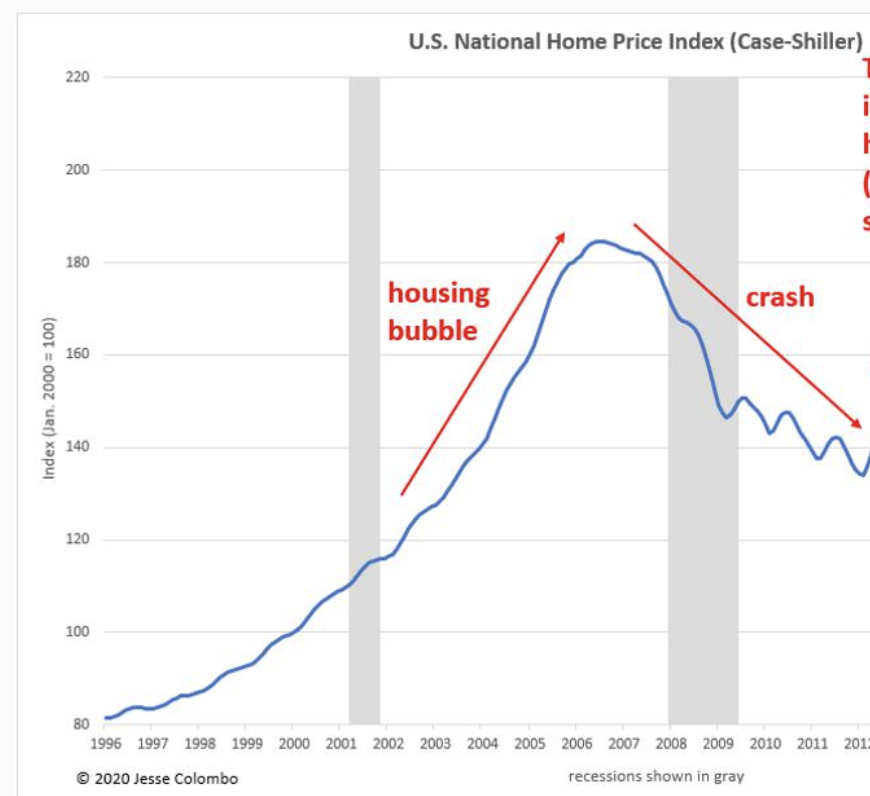

The crash of 2008 was easy to spot. I exhorted my readers to pretend they were sitting on the top of the housing price chart in the USA. "Dont you feel seriously giddy?" I asked. How many people took any notice is another matter, but I got out of stocks.

After the crash I should have bought back in, but I didn't, which was a bit of a mistake, but I was busy with internet matters, and it wasn't until 2015 that I realised that money was going digital, and I started following bitcoin. I advised my readers to buy when the price reached $282. A couple of years later I hassled my family to start buying quickly before it was too late. My alert went out as bitcoin hit $800. And (foolishly in retrospect) I stopped buying when the price hit $1,900.

So now you are probably all asking "What is the in-thing to buy right now"?

Find an expert in AI, Biotec, and AltCoins. They are the three important businesses these days, and all will deliver. You have to get the right instruments of course, and you need guidance for that, but I am loathe to suggest who to follow. All I will say is that if you email me I will tell you who I follow, but will say no more than that.

I am also investing in SPAC's. That is, Special Purchase Acquisition Companies. It's the new way to take a company public. It's early days so I cant point to much in the way of success just yet, but I'm confident this new market will produce the goods.

Next week I'll talk about how I think you should play the coming market crash that everyone is warning about.

|

Subscribe

to our email alerts on the housing markets both

in the UK and abroad.

|