The Unique Property

Site Blog

Competing Currencies

Watch on Youtube: https://youtu.be/pzWRZ188ptY

I do welcome responses, disagreements, and questions regarding my blogs. In the previous week's blog I ventured into the world of competing currencies being issued by the Big Tech companies, such as Apple, Google, Amazon, and Facebook, and I received a few comments and questions from Sean, who says:"As stablecoins are ... stable. One can't invest in said coin with hopes of any financial upside. Is it reasonable to think that an investment in the base company would reflect positively if, let's say, an amazon coin was to appear and 100 million users were suddenly funnelled into the currency of the platform?

... would that affect Amazon's price?

I agree with you that this is the way things are going and I'm pondering how to be positioned to capture some of these shifts [in] currencies if possible."

Let's start with an attempt at some definitions.

Bitcoin is usually described as a coin or currency. You can, in certain places, use it to pay for things. That's fine, but to be honest, bitcoin is useless as a currency. In our troubled times it is best regarded as a store of wealth. It's value against fiat currencies gyrates wildly. That's not good for a currency. Currencies need to be relatively stable. The trouble is when governments print money, and borrow even more against the local currency, that only serves to dilute its value. Every currency on the planet has lost value over the years. This means that stable coins are likely to lose value as well as long as they track just one government issued currency.

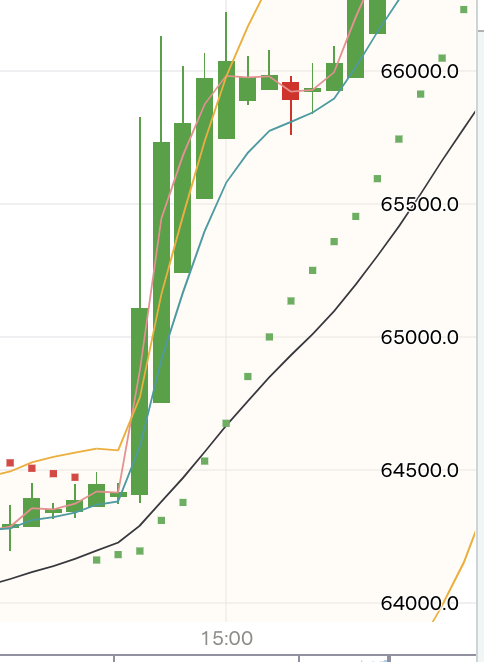

As for instability, I've been trading bitcoin today (wednesday October 20). Look at this chart. This is bitcoin's movements over the course of a few minutes. To get the information on the screen I am using 5 minute bars.

$1,500 value rise in 10 minutes!! There is no way you can use that type of currency to go out and buy a bottle of milk.

One only has to look at a modern example to see how badly governments treat their local currency. Approximately 110 years ago the USA government set up the Federal Reserve as a central bank to act as steward to the US dollar. Over the course of that time the value of the dollar has dropped over 97%.

Even more recently you'd need $510 today to buy what $100 would have bought back in 1975.

The Fed hasn't done a very good job, has it? Admittedly it has had successive incompetent governments to deal with, but financial stewardship is not something that is anywhere evident in the world today. That is precisely why Bitcoin was set up, to act as a form of money that would at the very least hold its value.

The other side of the question is: what we are to make of the various stable coins about to be issued by Big Tech?

Being stable coins, they are not designed to appreciate in value, although, if they are not outlawed they may very well do that. What will happen is, at the moment, anyone's guess. But I can't see how we can be worse off than we are now with the disgraceful way most governments are trashing our currencies.

But let's look at currencies from the point of view of the issuing company.

With the certain prospect of fiat currencies continuing to depreciate, why would a company want to get paid in such a currency? I'm sure most of us would prefer to be paid in a currency that is going to appreciate. That's what these companies hope will happen with their own currencies. It is also very useful to be in control of your own currency. But how can the company benefit if its own coin is pegged to one currency?

The use of the company's own currency is likely to make life easier for the company, but only marginally so. However, if you have several stable coins, and each one is linked to a different currency, what is to stop the company transferring its funds from a US dollar stable coin to a Japanese Yen stable coin when the dollar starts falling and the Yen starts rising? After all, this is precisely what Facebook's Diem currency is going to facilitate. It is intended to be issued in several formats, each being pegged to a different currency, and one further version pegged to a basket of currencies.

The real benefit to the issuing company will come from having control over the value of the money the company is getting from different parts of the world without having to muck about with expensive exchange transactions.

I'm sure the whole point of this is that the company will be able to run its affairs outside of any local jurisdiction. That is going to make its taxation position somewhat interesting. I would hate to suggest where this is going to go, but I rather like the idea of there being a currency that is a genuine alternative to fiat currencies run by governments behaving like drug addicts.

Finally there is Sean's third point: How does one invest in this crypto world?

That is another question altogether. I am not licensed to give out financial information, but what I will do next week is mention a few investments, and tell you what they do and where to find more information about them.

|

Subscribe

to our email alerts on the housing markets both

in the UK and abroad.

|